Let’s talk about the Earn Income Credit:

The Earned Income Tax Credit (EITC) it’s a credit for low to middle-class families to get a tax break. To claim this credit, you must have your W-2 from your employer(s) and your other tax forms if applicable. In this blog post, we will go over the qualifying factors and address the most common concerns.

Who qualifies for the Earn Income Credit?

Valid social Security number:

To start with, you must have valid social security that is valid for employment. Meaning you must be a USA citizen, resident, or have a valid social security number. The social security numbers are the ones that are label as “Not Valid for Employment”.

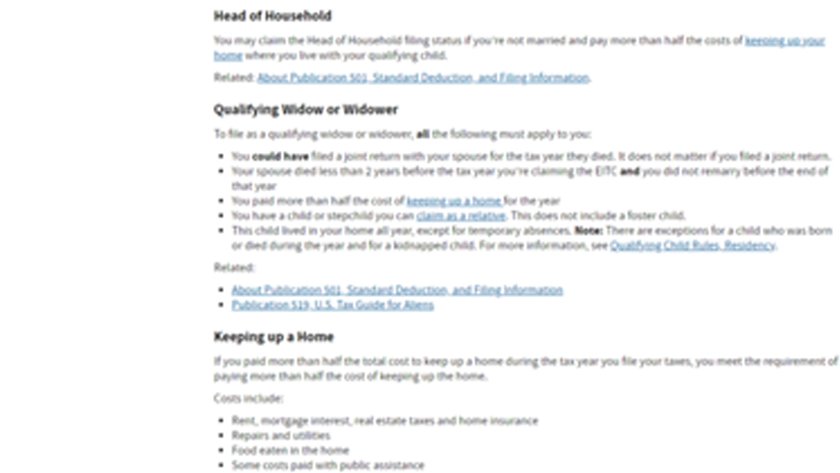

Filing Status:

You must file as Married filing jointly, single, head of household, or a qualifying widow. If you’re married and filing jointly, your spouse must have valid social security for you to claim this credit.

Who does not qualify?

Here are the disqualifiers:

2) File as married filing separately

1) If you or your spouse does not have valid social security (Other numbers like ITIN’S or ATIN would disqualify you from this credit).

These are the most common asked question and comment by many of our customers in the state of CALIFORNIA 2021:

I received a letter in the mail saying I qualify for the earn income credit, can I claim this credit?

First, you must meet all of the qualifications to claim this credit. We’ve noticed many employers have sent their employees Information about the Earn Income Credit. We recommend that you consult with your tax advisor if you don’t have one. We at Barron Income tax can help you determine if you qualify for this credit and many more! If you are not sure whether you should use a tax professional or a software service to file your tax returns; we recommend that you read Certified Tax Preparer vz. Online Tax Filing ( there you will learn the difference between filing with a tax preparer or doing it yourself).

My friends have received letters saying they qualify for the earn income credit, I want to claim this credit too!

Many companies have sent informational letters about the earn income credit, this could be due to the pandemic (COVID-19). We all know 2020 was a rough year for many individuals and businesses. Regardless of the situation, we have noticed more individuals asking for this credit in 2021. For the purposes of this article, we strongly encourage you to talk to a professional or look into the qualifications in more detail. If you are reading this from another state, have you notice many of your friends or relatives ask about this credit? Let us know in the comment sections. We will link the IRS source and the Certified Tax Preparer vz. Online Tax Filing below.

References: